Halfway success: Top performers of Q2 2023

Stay up to date with our IT market barometer for unbiased insights on reseller demand, top sellers, and product highlights.

ITscope market barometer Q2/2023 as a PDF (Englisch)

The ITscope market barometer is based on ITscope GmbH’s own analysis.

Karlsruhe, 20.07.2023 – Despite initial international expectations, the sales of new DDR5 memory modules have fallen short. However, there is a noticeable trend reversal in the B2B sector. The decreasing prices and smaller price difference compared to DDR4 models are making the new memory modules more appealing for office use. AMD also plays a significant role in the rise of DDR5 RAM. Unlike its competitor Intel, AMD exclusively designs its new AM5 platforms for the next-generation memory modules. The continuous setting of new records further contributes to the growing popularity of DDR5 memory. This success is evident on ITscope, one of the leading platforms for IT procurement and distribution in the B2B sector, where the interest in DDR5 memory chips and mainboards with corresponding sockets is steadily increasing. Is it finally time for DDR4 RAM to step aside?

Also in their supreme discipline, processors, AMD takes the top position in the second quarter with the AMD Ryzen 7 5800X3D. “One last hurrah for AM4” writes Hardware Luxx about the powerful gaming processor with 3D‑V cache. The most exciting up-and-comer among CPUs is the brand-new AMD Ryzen 7 7800X3D, which did not only make positive headlines. While Gamestar named it the “best gaming processor”, several users on Reddit reported burned out CPUs and motherboards. AMD has since issued a firmware update to combat “self-destruct mode.”

The most popular new products on the ITscope platform, the “Highflyers” are led this quarter by the Apple MacBook Pro, MPHE3D/A, which also convinces business customers with its M2 Pro chip. More unusual, however, is second place among the high-flyers: HP has managed to bring movement into the category with the E27 G5, 6N4E2AA#ABB LED monitor. The monitor is made from up to 90 percent recycled and renewable materials and hits the zeitgeist with the sustainability aspect.

Content

Highflyers: These new additions are taking off

Memory chips: greater demand for DDR5 in business

Mainboards: DDR5 sockets gaining popularity among high-end users

CPUs: AMD pioneering DDR5 modules

TFTs: Is sustainability the ultimate winner?

Mobile phones: Samsung models catching up

Notebooks: Prices fall in second quarter

PC systems: Proven models at the top

Highflyers: These new additions are taking off

The ITscope Highflyers, these are new products from the ICT sector that are particularly well received by our B2B customers. Our Top 30 list presents the most requested products from the last six months in each category for the quarter.

Place 1 goes to the former runner-up this quarter, the Apple MacBook Pro. The high-performance notebook with M2 Pro chip gets 1,563 clicks and scores with a comprehensive performance package and impresses with impressive computing power and a long battery life.

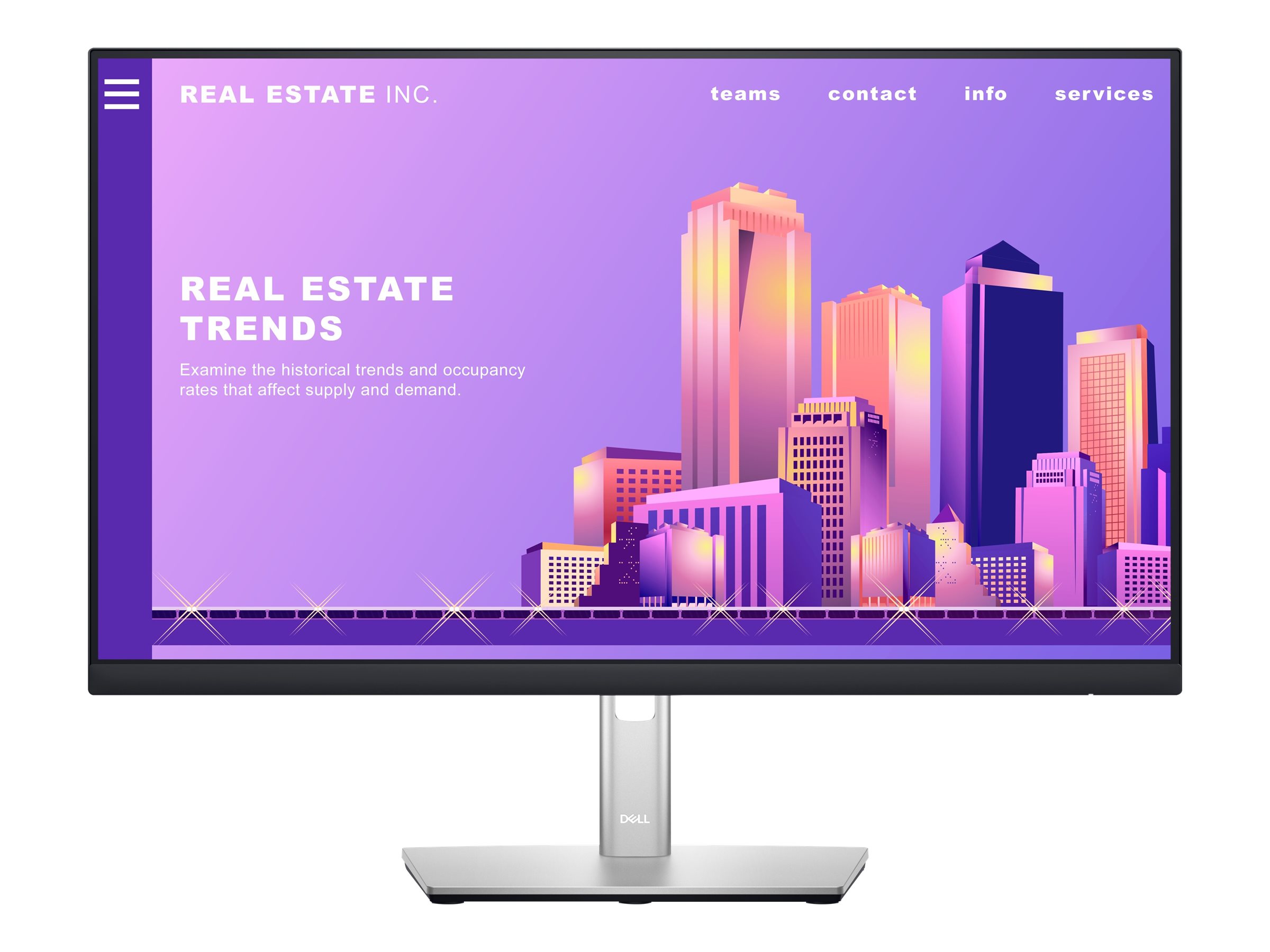

27-inch screen diagonal, Full HD resolution, flexible settings and connections: The HP E27 G5, 6N4E2AA#ABB LED monitor brings everything a business monitor needs and is equipped with features like HP Eye Ease to reduce blue screen light. In May, the average dealer purchase price (RRP) for the new monitor dropped by almost 30 euros. It promptly made it to place 2 in the highflyer ranking.

We find a different kind of display on place 6: The Iiyama ProLite TE8612MIS-B1AGis the largest and most expensive digital signage system in the top 1,000 on ITscope, but it certainly finds favour with 545 clicks. The interactive system offers 4K UHD resolution (3,480 x 2,160 px), integrated functions and apps, and touch pens. This makes the Iiyama ProLite TE8612MIS-B1AG the most popular new product and the third most popular digital signage system overall in ITscope. More frequently clicked are long-established models with a significantly lower price, namely the Samsung QM55B – 138 and the Iiyama ProLite T2252MSC-B1.

After a rather Weak start in the first quarter, the Samsung Galaxy S23, SM-S911BZKDEUB does pick up momentum and makes it to place 4 in our highflyers. With 1,038 clicks, however, the Samsung flagship is still well behind the first-placed Apple device.

Here are the most active 20 new releases with hot-seller potential – our Highflyer Charts:

| Pos. | Manufacturer and product name | Manufacturer no. | Listed since | Clicks |

|---|---|---|---|---|

| #1 | Apple MacBook Pro, 14.2″, M2 Pro | MPHE3D/A | 2023-01-18 | 1563 |

| # 2 | HP E27 G5, 27″, FHD | 6N4E2AA#ABB | 2023-01-18 | 1300 |

| # 3 | ZOTAC GAMING GeForce RTX 4070 Ti Trinity OC | ZT-D40710J-10P | 2023-01-06 | 1191 |

| # 4 | Samsung Galaxy A5 4, 128GB, grey | SM-A546BZKCEUB | 2023-02-08 | 1038 |

| # 5 | AMD Ryzen 7 7800X3D, 8‑Core, SMT, 4.5GHz, AM5, 96MB Cache, 100–100000910WOF | 100–100000910WOF | 2023-02-14 | 858 |

| # 6 | Iiyama ProLite TE8612MIS-B1AG | TE8612MIS-B1AG | 2023-02-08 | 545 |

| # 7 | Synology Disk Station DS423+ | DS423+ | 2023-02-18 | 495 |

| # 8 | Be Quiet! PurePower 12M, 850W, 12VHPWR, 80+ Gold | BN344 | 2023-01-25 | 340 |

| # 9 | Gigabyte B760 GAMING X DDR4, LGA1700, ATX | B760 GAMING X DDR4 | 2023-01-04 | 297 |

| # 10 | Kyocera M2040DN | M2040DN | 2023-03-25 | 280 |

| # 11 | Ortial Technologies 8GB DDR4 3200MHz SO-DIMM | CT8G4SFRA32A-ORT | 2023-02-24 | 262 |

| # 12 | Intel Next Unit of Computing 13 Pro Kit, i5 1340P, 2.5GigE, WIFI 6E | RNUC13ANKI50002 | 2023-03-29 | 209 |

| # 13 | Jabra Speak2 55 MS, 2755-109 | 2755-109 | 2023-02-28 | 208 |

| # 14 | UbiQuiti UniFi Protect G5, 2K, 5MP, PoE | UVC-G5-BULLET | 2023-02-21 | 207 |

| # 15 | Lenovo Tab P11 (2nd Gen), 11.5″, 128GB, Android | ZABM0034SE | 2023-02-02 | 204 |

| # 16 | Microsoft Surface TB4 Dock SC, Thunderbolt 4 | T8H-00002 | 2023-04-05 | 200 |

| # 17 | Iiyama MD CAR1021-B1 | MD CAR1021-B1 | 2023-01-18 | 178 |

| # 18 | Autodesk LT 2024 | 057P1-WW6525-L347 | 2023-03-18 | 177 |

| # 19 | BARCO ClickShare CX-50 Gen 2 | R9861622EUB2 | 2023-01-24 | 111 |

| # 20 | Dyson V15 Detect, 443099–01 | 443099–01 | 2023-03-21 | 97 |

Memory chips: greater demand for DDR5 in business

With the introduction of DDR5 memory chips, the initial high price hindered widespread adoption. However, as time has passed, the prices of both DDR4 and DDR5 RAM have been steadily decreasing and converging. This reduction in price difference has sparked increased interest in DDR5 RAM, particularly in the B2B sector. It is quite unusual for business customers to adopt new technology faster than private customers, but this can be attributed to the current economic situation, inflation, and the lingering effects of the Corona crisis.

DDR5 devices offer several technical advantages over DDR4 RAM, including improved efficiency and higher speeds. These enhancements are a result of factors such as higher clock rates and different memory architecture. Additionally, DDR5 chips have higher chip density, allowing for a theoretical maximum of 128 GB of memory per memory bar. In comparison, DDR4 RAM was limited to 32 GB.

The growing appeal of DDR5 memory is evident in the market, as businesses recognize the benefits it brings. The increased capacity, speed, and efficiency make DDR5 an enticing choice for those seeking optimal performance in their computing systems.

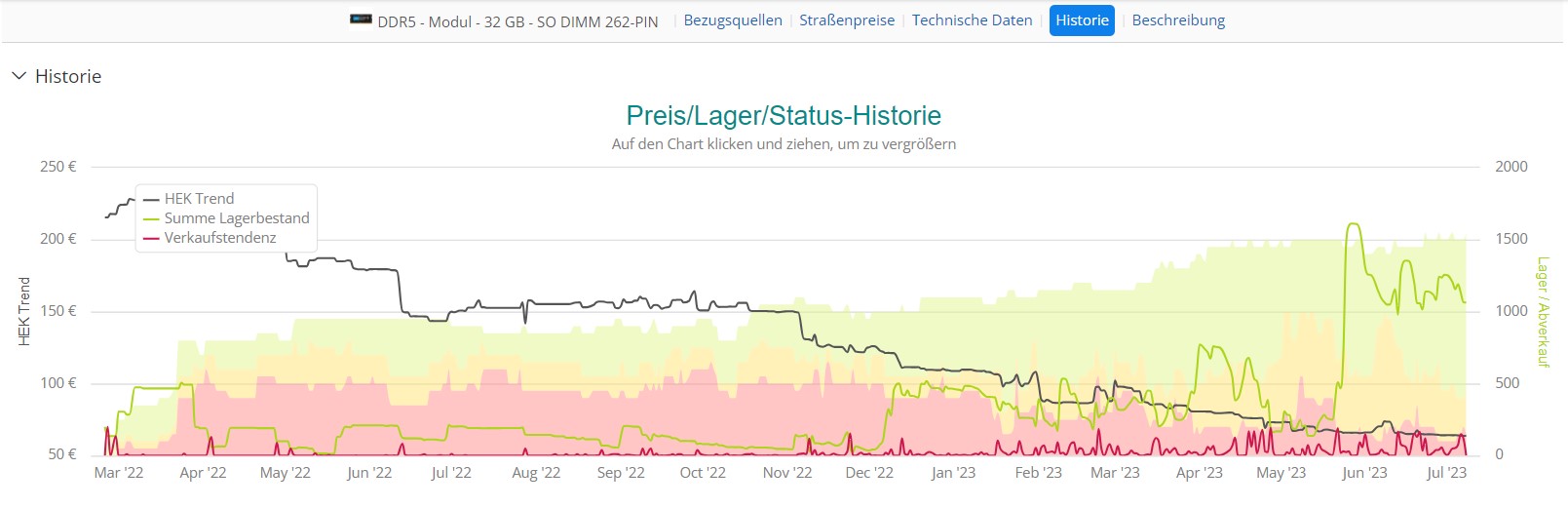

When DDR5 memory chips were introduced, the high price was a decisive purchase or rather non-purchase criterion: demand for the new RAM remained restrained. In the meantime, the prices of DDR4 and DDR5 RAM are increasingly converging. For both product groups, the price is falling, but the price difference is also decreasing. This is one reason why interest in the new RAM is increasing in the B2B sector. That business customers are adopting a technology faster than private customers is rather unusual, but can be explained by the current economic situation, inflation and the aftermath of the Corona crisis.

DDR5 devices technically offer more than DDR4 RAM, for example increased efficiency and higher speeds. The reason for this is, among other things, the higher clock rate or different memory architecture. The chip density is also higher, which is why theoretically up to 128 GB of memory are possible per memory bar. For comparison: with DDR4, the end was at 32 GB.

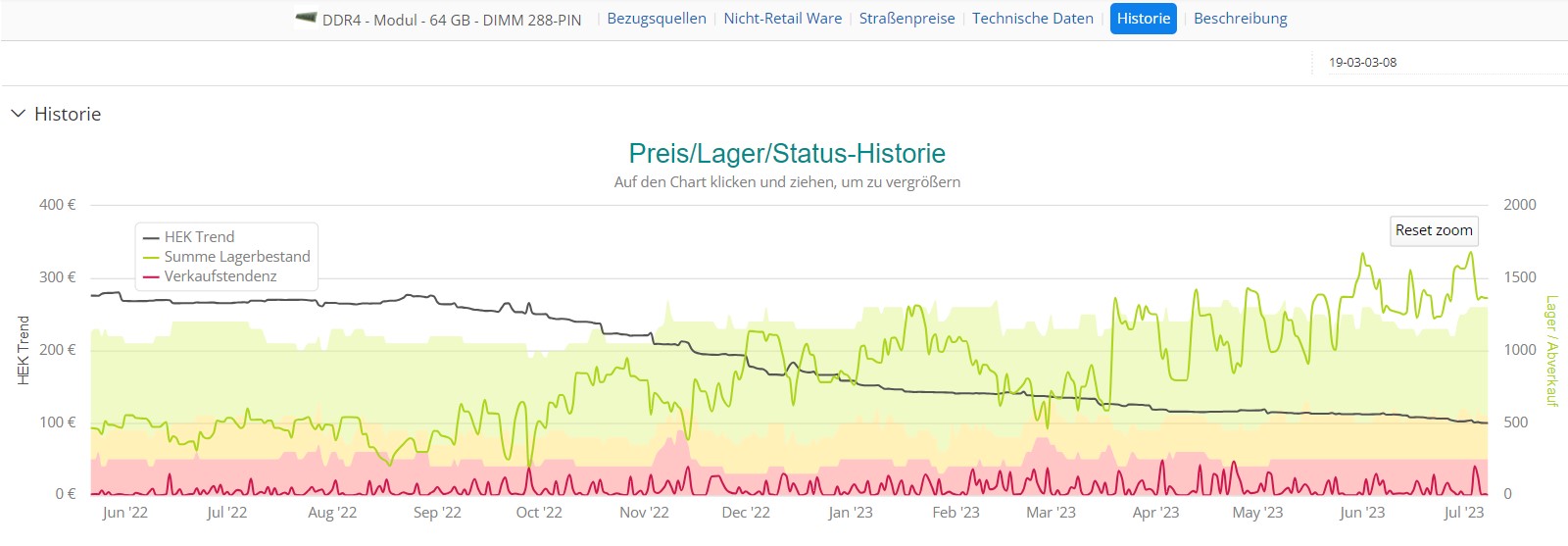

The demand for DDR4 components remains strong as they require different sockets and mainboards compared to DDR5. Users who still rely on computers with DDR4 sockets will continue to upgrade their systems with DDR4 memory in the upcoming months and, in some cases, even for years, depending on their specific needs and requirements.

So even the two most clicked memory devices on the ITscope platform are still DDR4 models, namely the cheap Crucial CT16G4SFRA32A 16GB DDR4 with a WSP of around €27 and the ECC memory HPE SmartMemory 32GB DDR4 for around €218*. ECC main memories have software that corrects errors, the so-called error correction code. This makes them particularly suitable for servers and business-critical data.

In third place, however, is the Crucial – DDR5 – Module – 16 GB, which is already available at a WSP of around 35 €*. The DDR5 memory modules from Crucial, the end-customer brand of Micron Technology, are rated by the trade press as simple but high-quality. So it’s hardly surprising that the Crucial – DDR5 – Module – 32 GB also made quite a climb in the second quarter: From 30th place, it climbs to 8th place in the memory module category.

When comparing the most popular modules, such as those from Crucial and CORSAIR, it is evident that there is currently a price gap of approximately 25%* between DDR4 and DDR5 modules with the same memory capacity. Notably, DDR5 modules also boast higher speeds in each instance.

The most popular 64GB memory modules are HPE SmartMemory 64GB DDR4 and the Samsung 64GB DDR4 3200MHz. For both modules, the WSP has dropped significantly since the beginning of the year. In the near future, there should also be DDR5 models with 24 and 48 GB from Crucial.

One more product received a remarkable number of clicks, and that was the memory module Ortial CT8G4SFRA32A-ORT – 8GB from Ortial Technologies, a private label of UK-based Techbuyer, which specialises in refurbished IT. The DDR4 module for notebooks has been listed exclusively by Techbuyer on ITscope since February 2023, making the jump from 213th to 16th place.

Mainboards: DDR5 sockets gaining popularity among high-end users

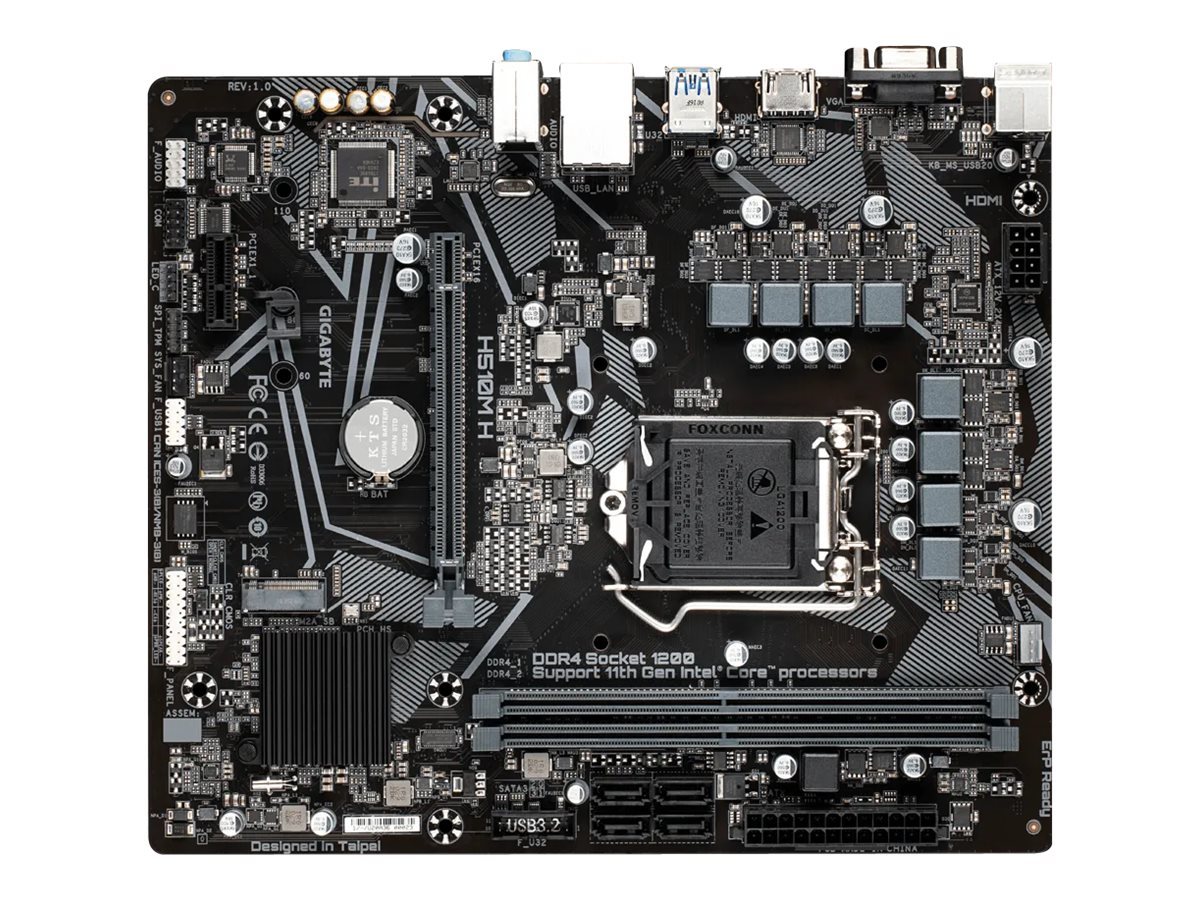

Whoever talks about DDR5 memory components also has to talk about mainboards. At first, there is a similar picture here as in the RAM area: still enthroned in first place is a model with a DDR4 socket, namely the Gigabyte H510M H – 1.0 – Motherboard, which is available for an average of 61 €* in purchase.

However, motherboards for DDR5 modules are increasingly gaining momentum, there are already several models in the top 10 of the second quarter. It is noticeable here that the more powerful models are in particular demand – among the inexpensive motherboards, DDR4 is the clear top dog. Fourth place in Q2 goes to the ASUS PRIME Z790‑P, which was released in autumn. The motherboard was released in autumn 2022 and is equipped with an LGA1700 socket.

Fighting its way up to 7th place is the MSI MAG B650 TOMAHAWK with an AM5 socket. The up-and-comer of the quarter, climbing from 126th place to the top 10. PC Games Hardware tested the motherboard and concludes, “Thanks to B650(E) top-tier motherboards, the AM5 socket is becoming increasingly attractive in terms of price.”

The mainboard high flyer of the quarter is the Gigabyte B760 GAMING X DDR4: although only listed since January, the mid-range motherboard is already the fifth most popular product in the category with 297 clicks.

CPUs: AMD pioneering DDR5 modules

DDR5 memory modules are gaining acceptance in the market, and this can be largely attributed to the pioneering efforts of AMD. AMD has taken the lead by designing its new AM5 processors and sockets exclusively for DDR5 RAM. On the other hand, Intel has been more cautious and has approved both DDR4 and DDR5 modules.

Also the CPU rising star of the quarter comes from AMD: The Ryzen 7 7800X3D with AM5 socket and 4.2 GHz climbs from place 211 to place 4. This makes the CPU, which has been listed since February, a real highflyer on ITscope. Even Gamestar is impressed by the processor, in addition to its performance and efficiency. “The AMD Ryzen 7 7800X3D is currently the best gaming processor overall,” writes the editorial team. At the same time, the new processor has certainly also written negative headlines: Several users reported on Reddit about burned-out CPUs and motherboards. An analysis showed that a combination of several factors, including overcurrent and missing protection mechanisms, led to the defect. AMD, as well as several motherboard manufacturers, have since released BIOS and firmware updates that limit the voltage and thus prevent the problem.

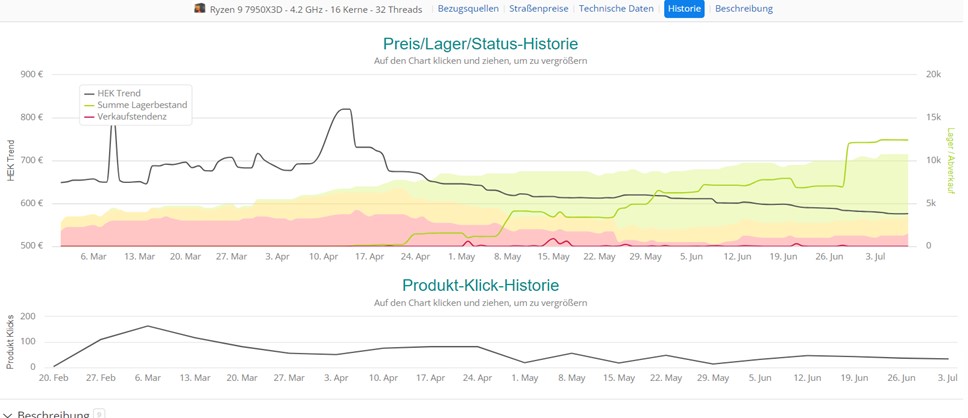

First place in the processors category also goes to AMD, but with the AM4 socket AMD Ryzen 7 5800X3D. The 8‑core CPU has already been on the market for a year and has received good reviews, for example from Hardware Luxx, which headlined: “A last hurrah for AM4”. Totally, the processor recorded 1,072 clicks on the ITscope platform.

AMD’s top-of-the-line 2023 model, the AMD Ryzen 9 7950X3D improves from 11th to 7th place. The processor was hard to get until mid-April. This is precisely why there was already a lot of interest in the CPU in ITscope at the end of February, as can be seen from the product click history.

TFTs: Is sustainability the ultimate winner?

Bam! With 1,300 clicks, the HP E27 G5, 6N4E2AA#ABB LED monitor has made it straight into the top 10 TFT monitors – and thus into a category that is otherwise rather ponderous. All in all, the 27-inch monitor from HP is a solid model with a resolution of 1920×1080 (Full-HD) that is suitable for both the office and the home. What sets the new HP E‑Series G5 monitors apart from their predecessors and numerous other models, however, is that they are made from up to 90 percent recycled and renewable materials. The trend is also moving towards more sustainability and Green IT in the B2B sector, recycled and sustainably manufactured electronic products are definitely in demand.

Not to be knocked off its throne, meanwhile, is the Dell P2422H. Dell’s 24-incher is a real perennial favourite in business and once again managed a whopping 6,033 clicks in the second quarter.

Mobile phones: Samsung models catching up

Apple’s iPhones topping the top mobile phone list is nothing new. What is interesting this quarter, however, is that the iPhone SE (3rd Generation) and the iPhone 13 in the top spots, ahead of the two newest models, the iPhone 14 and the iPhone 14 Pro. While the iPhone SE is priced well below the new models, the 13 model is only about 50 euros cheaper than the 14*. In fact, the two iPhones are on a par in the test by Computerbild. There are marginal differences in the camera, the design and the battery life.

There is an upswing for Samsung’s new mobile phones in Q2: The Samsung Galaxy S23 receives 1,054 clicks and thus rises to 6th place in the category. So far, the smartphone has received good reviews, but the competition is already waiting in the wings: the Chinese manufacturer Nubia is releasing a smartphone with a comparable, tuned processor. The Shenzen-based company makes high-end smartphones, tablets and wearables and is also gaining relevance in Germany.

The Samsung Galaxy A54 5G is also off to a rocket start: it climbs from 101st to 7th place and is only just behind the flagship with 1,038 clicks. The smartphone with an average WSP of around €318* mixes up the mid-range and, like Samsung’s entire A‑class, has a good price-performance ratio. What is unusual is that the display has shrunk from 6.5 to 6.4 inches compared to its predecessor, the A53 – actually, the trend is more in the opposite direction.

Notebooks: Prices fall in second quarter

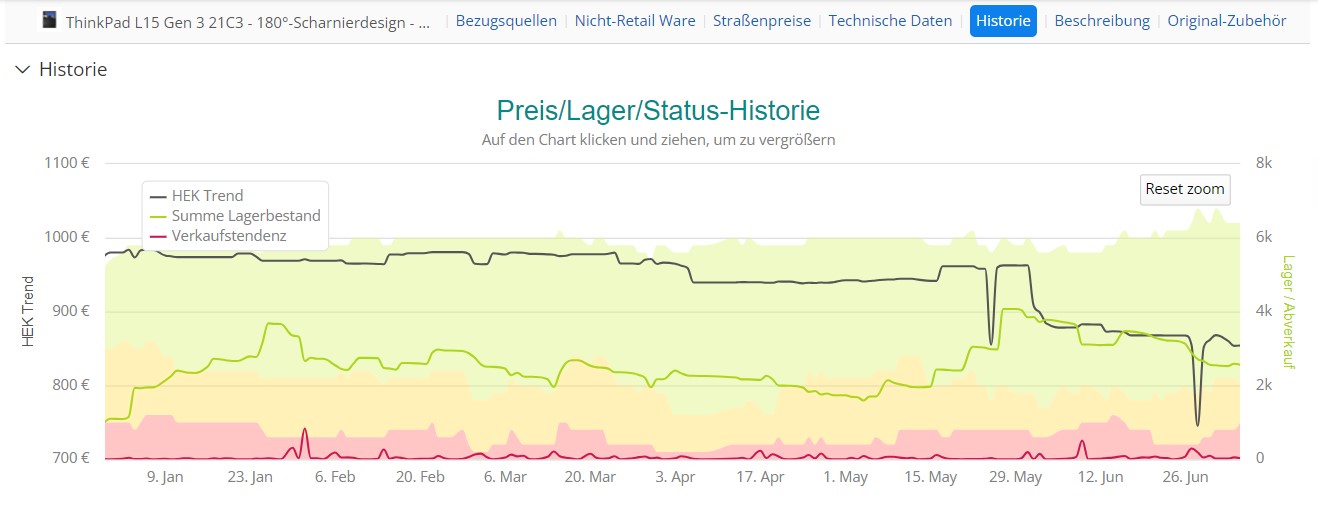

It is and remains the rage in business: the Lenovo ThinkPad L15 Gen 3 21C3 is once again the clear winner of the notebook category with 6,737 clicks. It has a powerful i5 processor with 4.4 GHz, an SSD with 512 GB and 16 GB RAM. The average WSP dropped again significantly in June, which makes the all-rounder still attractive.

From 31 May to 6 June, the average HEK for the Lenovo ThinkPad L15 Gen 3 21C3 fell from €963 to around €878*.

In second place is again a HP ProBook 450 G9. However, where the “small” version with i5 processor was still ahead in the last quarter, the i7 variant is now in the lead. The notebooks with i5 processors are less in demand: the ProBook 455 G9 has slipped from 9th to 20th place and the ProBook 450 with i5 processor from 2nd to 11th place. HP ProBooks also saw some significant price drops in the second quarter.

Rising star of the quarter is the Lenovo V17 G3 IAP 82U1 with Intel i3 processor, or as Notebooksbilliger. de says: “A really good office notebook”. It climbs from 48th to 12th place. HP 470 G9 notebook also makes it into the top 20 – despite rather negative reviews, such as from LaptopMedia (“Great screen, bad performance”).

PC systems: Proven models at the top

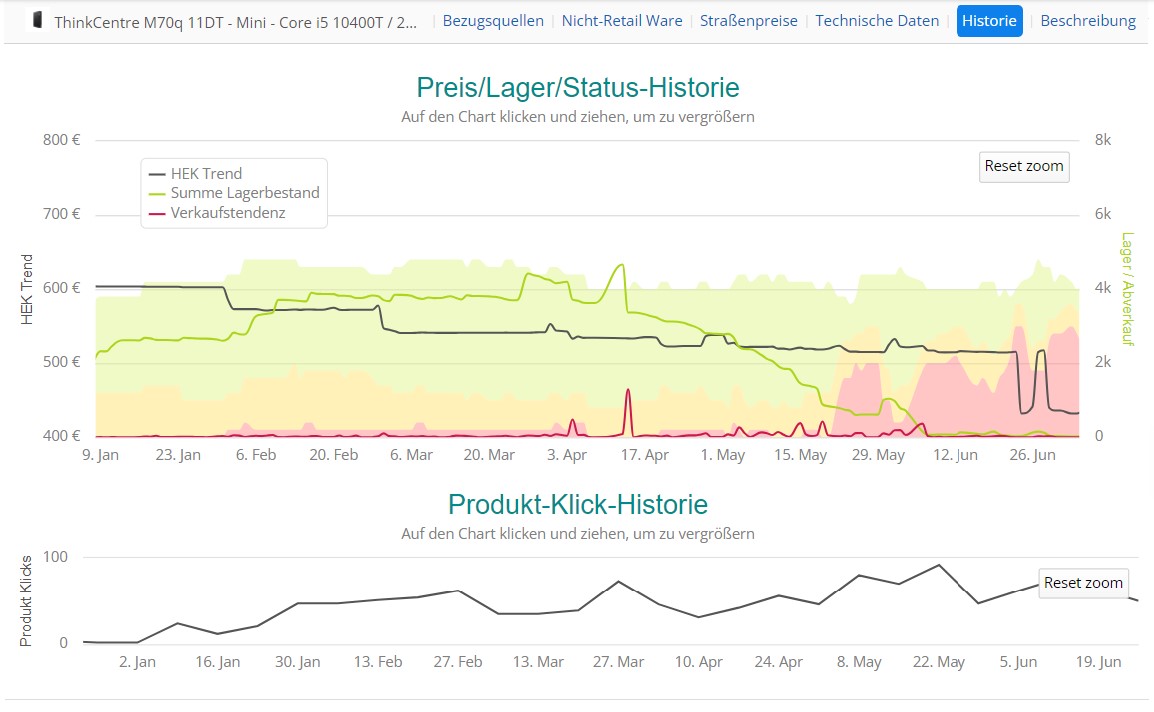

Continuing their reign, the top 5 complete PC systems remain unshaken at the forefront of our category charts, maintaining their position from the beginning of the year throughout the second quarter of 2023. These tried and tested systems have proven their worth and continue to capture the attention of users seeking reliable and high-performing PC solutions. In front is the HP Pro Mini 400 G9, i5 2GHz, the slightly larger version of which with 16 GB of RAM follows in third place. Second and fifth place go to Lenovo with the Lenovo ThinkCentre M70q Gen 3 with 8GB and 16GB of memory respectively, and in fourth place is the Dell OptiPlex 3000.

The Lenovo ThinkCentre M70q 11DT with i5 processor makes it to rank 6, although – or precisely because – it is no longer available from all distributors. The previous model achieved absolute gold status on ITscope, and the 2022 model is already among the top sellers. The compact business-level desktop PC features an Intel i5 processor, 16GB of DDR4 ram and a 512GB SSD.

It was only in June that Lenovo announced that its manufacturing plant in Budapest, Hungary, which opened in 2022, had already produced one million units. The company wants to hedge against supply chain uncertainties with the plant in Europe.

An exciting new entry from Lenovo is the ThinkCentre M75q Gen 2, which still makes it to 31st place in the category with 330 clicks. The complete system from Lenovo’s “Tiny” series was awarded “Best Mini PC” by AllesBeste.de. Another mini PC is the Fujitsu ESPRIMO G6012. It rises to 7th place in the category with 781 clicks.

* Average wholesale price (WSP) as of 1st July 2023 from ITscope.

Press contact

Sylvia Schreiber

Durlacher Allee 73

76131 Karlsruhe

Germany

Tel.: +49 721 62 73 76 – 29

sylvia.schreiber@itscope.com

www.itscope.com

About the ITscope Market barometer

ITscope is one of the leading platforms for IT procurement and sales in the B2B sector. It provides valuable support to system houses, resellers, distributors, and manufacturers in their digitalization efforts. One of the highlights of ITscope is its quarterly publication, the ITscope Market Barometer, which offers intriguing insights into the ever-evolving ICT industry. This includes identifying the most sought-after products among B2B customers and monitoring the fluctuating purchase prices of smartphones, notebooks, and processors. With its comprehensive market analysis, ITscope offers exclusive and valuable insights into the sales trends and market dynamics of the channel.